What is the Pullus Innovative Financing (PIF)?

The Pullus Innovative Financing (PIF) is an initiative by Pullus Africa designed to support smallholder poultry farmers by providing access to affordable financing.

Our goal is to help farmers scale production, increase profitability, and meet market demands with ease.

Who is eligible for PIF?

To qualify for the Pullus Innovative Financing, applicants must:

- Be an active poultry farmer.

- Must be a Pullus Farmer with a Farmers Identification Code

- Must belong to a Cluster

- Have previously sold birds to Pullus Africa.

- Be willing to adhere to standard poultry production and biosecurity practices.

- Demonstrate commitment to maintaining high-quality poultry farming standards.

Who is eligible for PIF?

To qualify for the Pullus Innovative Financing, applicants must:

- Be an active poultry farmer.

- Must be a Pullus Farmer with a Farmers Identification Code

- Must belong to a Cluster

- Have previously sold birds to Pullus Africa.

- Be willing to adhere to standard poultry production and biosecurity practices.

- Demonstrate commitment to maintaining high-quality poultry farming standards.

What are the benefits of PIF?

Smallscale poultry farmers can:

- A guaranteed off-take agreement with Pullus Africa.

- Access input loans to increase capacity

- Improve operational efficiency and profitability.

- Receive expert guidance on poultry management and production.

- Insurance of the birds against outbreaks

How does the funding process work?

- Application: Farmers submit an application detailing their poultry business.

- Assessment: Pullus Africa reviews applications to verify eligibility and capacity.

- Approval & Disbursement: Qualified farmers receive inputs to support their poultry production.

- Monitoring & Support: Our team provides continuous guidance and ensures compliance with best practices.

- Repayment: Farmers is paid less the loan value, at most 24 hours after offtake

How does the funding process work?

- Application: Farmers submit an application detailing their poultry business.

- Assessment: Pullus Africa reviews applications to verify eligibility and capacity.

- Approval & Disbursement: Qualified farmers receive inputs to support their poultry production.

- Monitoring & Support: Our team provides continuous guidance and ensures compliance with best practices.

- Repayment: Farmers is paid less the loan value, at most 24 hours after offtake

-

How do I apply for PIF?

Interested farmers can apply by filling this form, or visit our nearest Pullus Africa's office for assistance.

Why should I choose PIF?

PIF is more than just financing—it’s a comprehensive support system for smallscale poultry farmers.

By participating, you gain not only access to funding but also a strong partnership with Pullus Africa, ensuring long-term growth and stability in poultry farming.

SCORECARD

-

%

%Benefited more than once

-

%

%Females

-

%

%Loan Repayment

-

Clusters

Frequently Ask questions

PIF is a financing program by Pullus Africa designed to provide poultry farmers with input loans, primarily covering feed costs, to support their production and ensure a steady supply of quality poultry.

To qualify, a farmer must:

- Be an active poultry farmer in a recognized and active Pullus cluster.

- Have at least two guarantors.

- Must have sold Birds to Pullus Africa before?

- Obtain consent from the cluster leader.

- Commit to selling the birds to Pullus Africa.

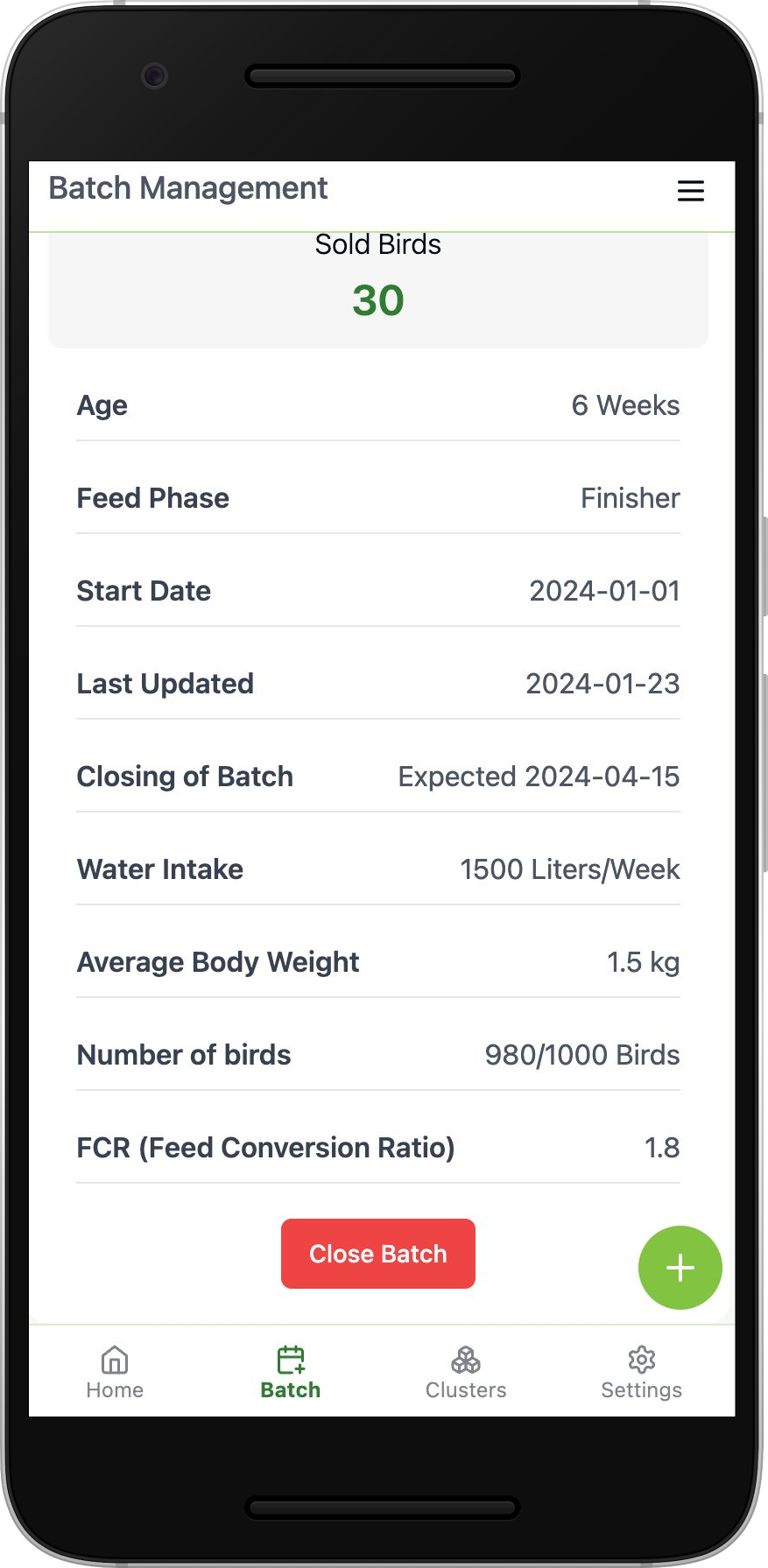

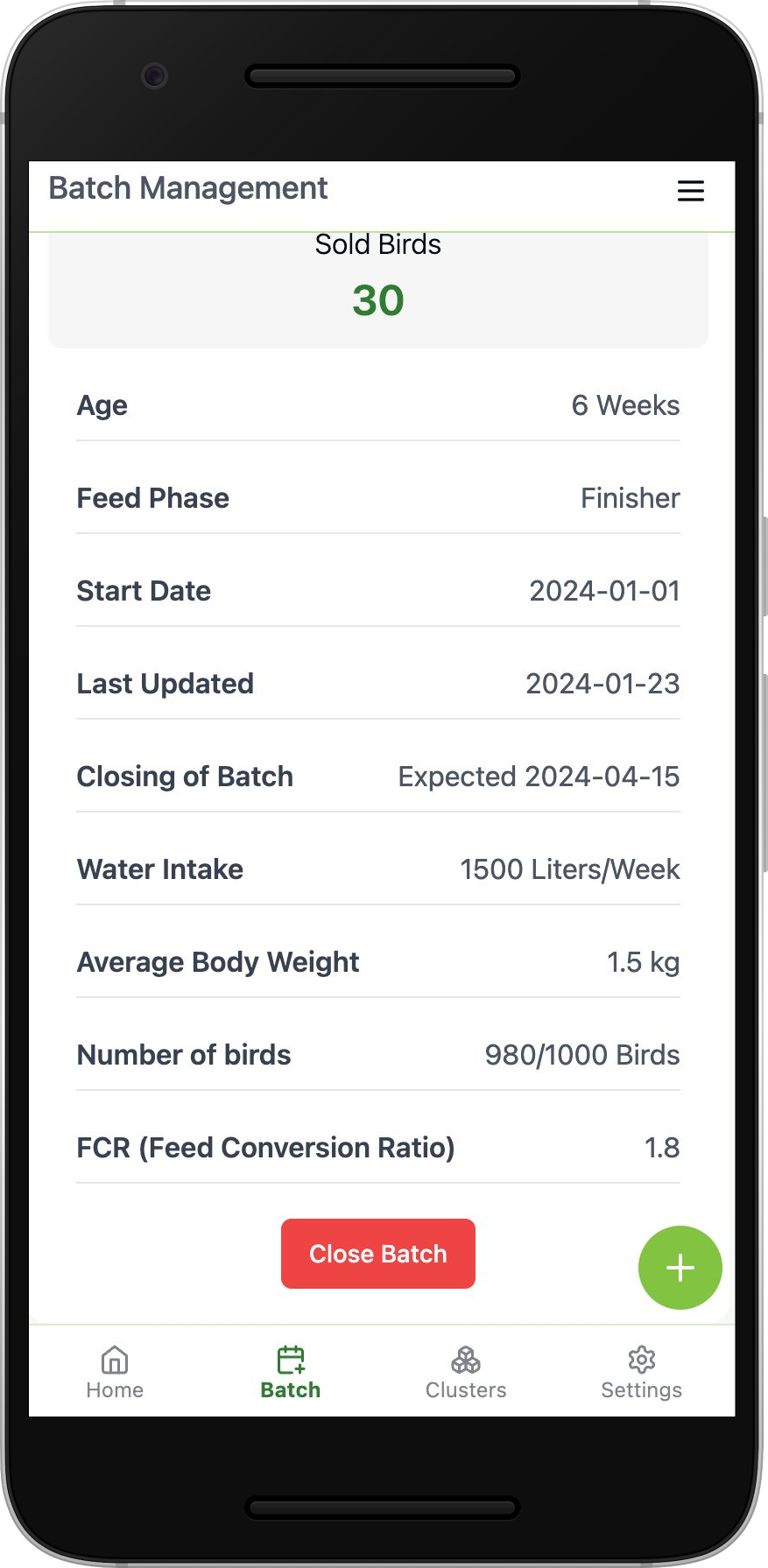

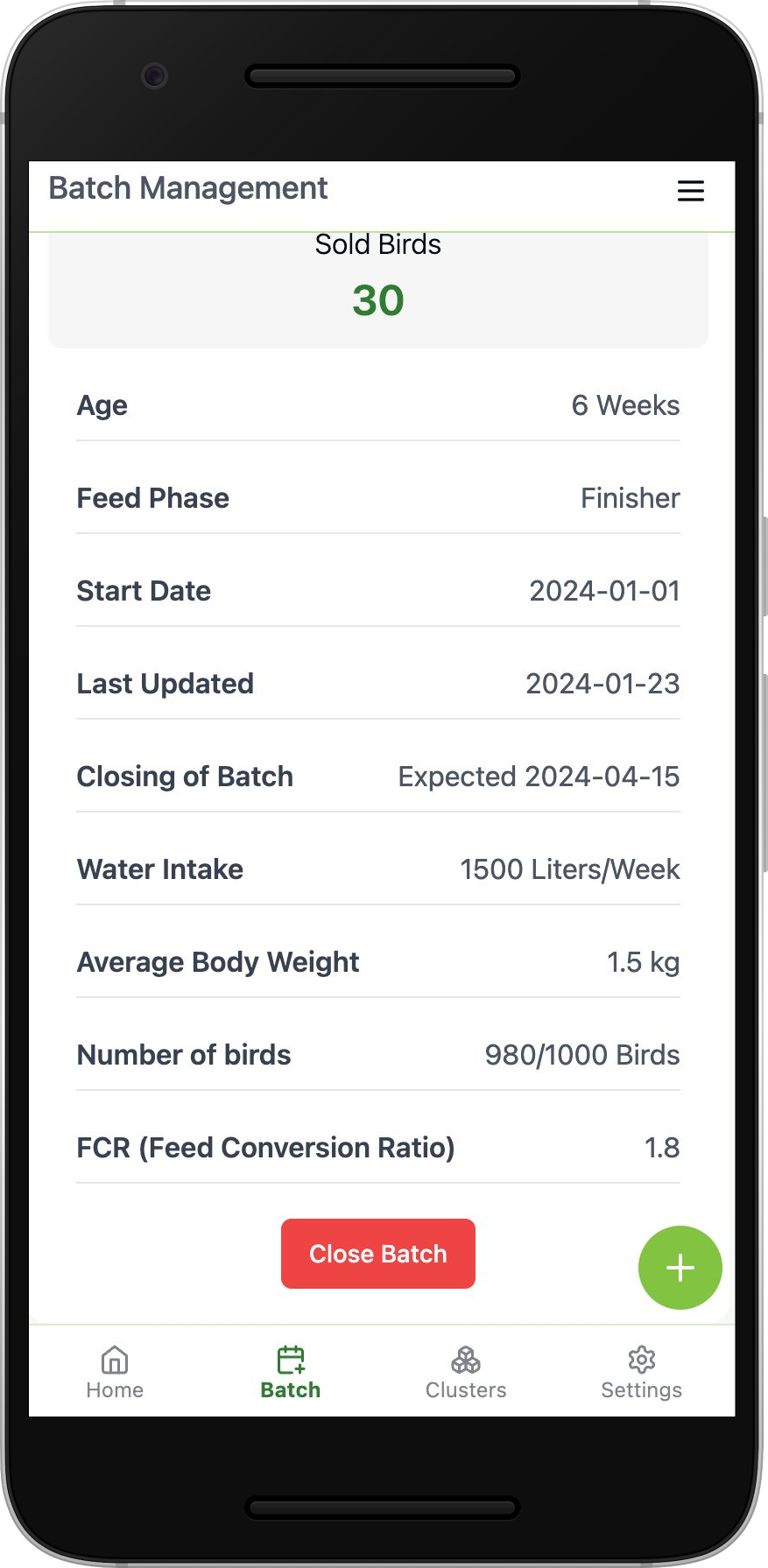

- Be signed up on the Pullus APP

The loan primarily covers a certain percentage of the feed for rearing the number of approved Birds, which is a critical factor in poultry production. Other possible inputs may be considered based on need and availability.

Repayment is structured to align with the farmer’s sales. Farmers are required to sell their birds to Pullus Africa at an agreed price, from which the loan repayment is deducted.

To secure repayment, PIF requires:

- A refundable equity fund (returned if there is no default).

- Weekly farm visits by Pullus staff for monitoring.

- Guarantors and cluster leader oversight.

If a farmer defaults, the equity fund may be used as a guarantee. Additionally, the farmer’s guarantors and cluster leader will be involved in resolving the issue. Persistent defaults may result in ineligibility for future loans and that of farmers cluster.

PIF offers ongoing support, including:

- Regular farm visits for monitoring and advisory services.

- Access to quality inputs and technical guidance.

- A structured market through Pullus Africa for guaranteed offtake.

The processing time varies but typically takes between 7-14 days, depending on the completion of verification, approval, and agreement signing.

A farmer can apply for another loan only after successfully repaying the previous one. Loan limits may also increase or decrease based on a farmer’s repayment history and performance.

Farmers can apply through:

- Completing the official PIF application form, which includes all required documents and guarantor details.

- Visit the office.